July 9, 2012

Tyler Fleming

Director, Stakeholder Relations and Communications

401 Bay Street

Suite 1505, P.O. Box 5

Toronto, ON M5H 2Y4

Sent via e-mail to: publicaffairs@obsi.ca

RE: Request for Comments on Proposed Changes relating to OBSI’s Suitability and Loss Assessment Process

FAIR Canada is pleased to offer comments on the Ombudsman for Banking Services and Investments’ (“OBSI”) Summary of Public Comments Relating to OBSI’s Suitability and Loss Assessment Process, and Request for Comments on Proposed Changes dated May 10, 2012 (the “Consultation”).

FAIR Canada is a national, non-profit organization dedicated to putting investors first. As a voice of Canadian investors, FAIR Canada is committed to advocating for stronger investor protections in securities regulation. Visit faircanada.ca for more information.

FAIR Canada Comments and Recommendations – Executive Summary

- FAIR Canada is supportive of OBSI and the role it plays in resolving investment disputes between retail investors and their investment firms. OBSI plays a crucial role in dispute resolution and redress, which is a critical component of investor protection in Canada. FAIR Canada believes that a single, national ombudservice for banking and investment complaints is vital to the integrity of the Canadian financial services market.

- In FAIR Canada’s view, the amendments proposed in the Consultation are illustrative of the pressure exerted upon OBSI by the financial industry that created it to circumvent attempts to impose a statutory ombudservice. OBSI has been left in a very vulnerable position following the withdrawal of two Canadian banks and the Canadian government’s decision[1] to not mandate OBSI participation by banks. As a result, OBSI’s survival depends upon the mandatory participation of self-regulatory organization (“SRO”) member firms (on the investments side) and the voluntary participation by the remaining banks (on the banking side).

- FAIR Canada considers OBSI’s current suitability and loss assessment process to be fair. We agree with the Khoury Report’s conclusion that “…OBSI’s approach to investment loss is based on sound logic, provides a fair and transparent platform for well-founded, consistent decisionmaking and is consistent with other jurisdictions”[2]. This independent review of OBSI, conducted in 2011, determined that “OBSI’s investment loss methodology is competent and highly consistent with that used in the other comparable jurisdictions.”[3]

- FAIR Canada does not support several of the proposed changes outlined in the Consultation. In particular, FAIR Canada does not agree with the proposal to use common indices as performance benchmarks in most suitable performance comparison calculations. Instead, we suggest that OBSI continue to conduct suitable performance comparisons based on the particular facts and circumstances of each individual case. Where there is compelling evidence of what securities the client would have invested in, FAIR Canada believes that OBSI should assess the consumer’s losses based on a comparison of the performance of these securities with the performance of the unsuitable investment(s) that was recommended. Where there is no compelling evidence of what the client would have invested in, FAIR Canada agrees that the use of prescribed indices would be appropriate.

- FAIR Canada agrees that it is reasonable to adjust index performance for reasonable and appropriate fees or trading costs. FAIR Canada suggests that adjustments be made for the reasonable costs that would have been incurred in an index-investing strategy, such a low-cost, non-actively managed investment (for example, a low-cost ETF or index mutual fund), as opposed to a mutual fund with high fees and costs.

- FAIR Canada proposes a different approach to calculating interest for loss of use than the approach put forward in OBSI’s consultation. We suggest that OBSI include interest calculated from the fixed date for loss calculation to the time that compensation is paid to the complainant. In our view, our recommendation is more directly aligned with the intended purpose of awarding interest for loss of use, in that it compensates the consumer for the time they should have had use of their funds but did not. It is also consistent with the approach taken by the U.K. Financial Ombudsman Service.

- FAIR Canada agrees that a limitation period of six years from the time when the consumer knew or ought to have known there was a problem with their investments is fair, provided that a subjective standard is used.

- FAIR Canada questions why OBSI would propose to share versions of its loss calculation spreadsheets with firms without also sharing these with complainants. If firms are provided with working versions, FAIR Canada submits that such should also be provided to complainants, to allow them to participate fully in the dispute resolution process.

- FAIR Canada cautions that any application of “investor responsibility” or mitigation principles to a loss methodology calculation must take into consideration the asymmetry of experience, power, and resources between the client and the advisor and firm. Further, FAIR Canada suggests that if consumers are required to mitigate their losses, firms and advisors should also have an obligation to assist consumers in mitigating losses.

- FAIR Canada recommends that OBSI explicitly include the use of leverage as a strategy it would include in its suitability assessment process.

1. General

1.1. FAIR Canada is supportive of OBSI and the role it plays in resolving investment disputes between retail investors and their investment firms. OBSI plays a crucial role in dispute resolution and redress, which is a critical component of investor protection in Canada.

1.2. In FAIR Canada’s view, the proposed amendments are illustrative of the pressure exerted upon OBSI by the financial industry that created it to circumvent attempts to impose a statutory banking ombudsman. OBSI has been left in a very vulnerable position following the withdrawal of two Canadian banks and the Canadian government’s decision[4] that it will not mandate participation by banks. As a result, OBSI’s survival depends on provincial securities regulators’ support of the mandatory participation of self-regulatory organization (“SRO”) member firms (on the investments side) and on the voluntary participation by the remaining banks (on the banking side). The industry holds a great deal of power over OBSI at the present time.

1.3. FAIR Canada considers OBSI’s current suitability and loss assessment process to be fair. We agree with the Khoury Report’s conclusion that “…OBSI’s approach to investment loss is based on sound logic, provides a fair and transparent platform for well-founded, consistent decisionmaking and is consistent with other jurisdictions.”[5] This independent review of OBSI, conducted in 2011, determined that “OBSI’s investment loss methodology is competent and highly consistent with that used in the other comparable jurisdictions.”[6]

1.4. As a result of the foregoing, FAIR Canada does not support several of the proposed changes outlined in the Consultation, as we discuss below.

2. Continue to use investors’ suitable investments as the benchmark.

2.1. FAIR Canada emphasizes that OBSI’s role is to investigate complaints with a view to resolving them in a manner that is fair and reasonable in all the circumstances. The primary goal is not to be predictable, uniform, or to resolve complaints as quickly as possible. While we agree that, to the extent possible, OBSI’s loss calculations should be objective, consistent, and predictable, these are not the objectives or guiding principles set out in section 25 of OBSI’s Terms of Reference.[7]

2.2. FAIR Canada does not support OBSI’s proposed change with respect to using common indices in most suitable performance comparisons. What is fair and reasonable will depend on the particular facts and circumstances, including whether the most appropriate investment for comparison is an index, a fixed income investment or some other investment (or some other portfolio of investments). In FAIR Canada’s view, this proposal would be a step backward, toward a “one size fits all” approach; OBSI’s current investor-specific approach to loss assessment is one of its strengths in investment complaint resolution.

2.3. Furthermore, we agree with OBSI that suitable performance comparisons do not result in arbitrary outcomes. Suitable performance comparisons provide the most reasonable representations of how an investor’s portfolio would have performed had that investor’s funds been suitably invested.

Where there is no clear evidence of how the investor would have likely invested

2.4. It is our understanding that in the majority of cases there is no clear evidence of how the investor would have likely invested but for the unsuitable advice. In these instances, FAIR Canada supports the use of appropriate indices. We fully support OBSI’s proposal to make the choice of benchmarks clearer and narrower and to apply them based on what would have been suitable for the investor in the particular circumstances of that investor’s case.

Where there is compelling evidence of how the investor would have likely invested

2.5. It is imperative that OBSI’s loss calculations be made in a manner that is fair and reasonable. In some cases it would be fairer to consumers seeking compensation to calculate their losses based on the investments they would have purchased had the advisor made suitable recommendations to them than assessing losses based on indices. OBSI’s goal in making a recommendation for compensation is to compare the investor’s position to the position the investor would have been in if suitable advice had been provided; if there is evidence available to indicate how the investor would have likely invested had suitable advice been provided, we believe that this should be the loss calculation process used.

2.6. OBSI has indicated that professional advice it received suggests that indices are typically used as benchmarks to calculate and compare investment performance for compensation purposes in privately-settled investment disputes as well as in the courts. In our view, the methodology used in private settlements and court proceedings should not determine OBSI’s loss assessment process. OBSI serves a very different function than that of private settlements and court actions and these other methods of dispute resolution are not mandated to develop solutions that are fair in all the circumstances. Furthermore, FAIR Canada believes that OBSI should make this professional advice public, in order to enable stakeholders to understand and evaluate the rationale for this recommendation.

2.7. FAIR Canada recommends that OBSI not change its suitability and loss assessment process to use common indices as performance benchmarks in most suitable performance comparisons. FAIR Canada supports the continued use of the investments clients would have purchased had there been suitable advice in the suitable performance comparisons where there is clear evidence of what the client would have purchased.

3. Consider fees and trading costs.

3.1. In cases where the index benchmark will be used, FAIR Canada agrees that it is reasonable to adjust index performance for reasonable and appropriate fees or trading costs. However, FAIR Canada disagrees with the suggestion that embedded costs, such as the fees that are included as part of a mutual fund’s management expense ratio (which will invariably include trailer fees paid to the firm/advisor providing the unsuitable advice), should be deducted. Instead, we suggest that adjustments should be made for the reasonable costs that would have been incurred in a low-cost, non-actively managed investment such as a low-cost ETF or index mutual fund.

3.2. If there is no compelling evidence of what the consumer would have invested in, and hence an index is used, FAIR Canada’s opinion is that it would be unfair to infer that the consumer’s suitable performance would be fairly represented by the performance of an index but that high mutual fund fees would also have been incurred. Similar fees and trading costs should be applied to ensure that the costs or fees are reflective of the benchmark used.

4. Award interest from the fixed date of loss calculation.

4.1. OBSI currently calculates interest on compensable loss from the date the client complained to the firm to the date OBSI’s report is final. OBSI has proposed to add interest on compensable losses only if an Investigation Report (a final report where OBSI recommends compensation) is issued, but not to add interest on facilitated settlements.

4.2. FAIR Canada views OBSI’s proposed loss of use interest provision to arbitrarily differentiate between cases resolved through facilitated settlements and those resolved through Investigation Reports. Consumers are unconcerned about the classification of the resolution of their case; consumers are much more concerned with how long it takes for them to obtain a fair resolution and receive compensation. We believe that OBSI’s unarticulated rationale for differentiating between facilitated settlement and Investigation Report cases is that it takes longer in Investigation Report cases for a resolution to be reached with the investment firm. Additionally, we understand that OBSI spends considerably more time and resources on cases that are resolved through Investigation Reports.

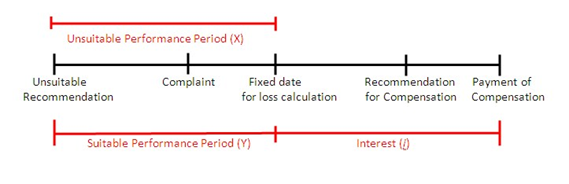

4.3. Given that interest accumulates over time and is assessed at a conservative rate, requiring firms to pay interest from the fixed date for loss calculation (i.e. the end date, as determined by OBSI, of the period for which the performance of the unsuitable and the suitable investments are compared) to the time compensation is paid to the complainant would incentivize firms to settle claims in a timely manner. We illustrate our proposed method below.

4.4. In a simple case, the recommended award would be the difference between the performance of the suitable investment(s) (Y) and the performance of the unsuitable investment(s) (X), multiplied by one plus the appropriate rate of interest for the period in question (1+i).

4.5. Awarding interest for loss of use is an appropriate element of a compensation system intended to put the consumer in the position they would have been in but for unsuitable advice. In order to restore the consumer to such a position, interest should not be viewed as a penalty to the firm, but rather as an amount to which the consumer is entitled for the time they should have had use of the funds but did not.

4.6. We note that the approach we recommend above is similar to the approach taken by the UK Financial Ombudsman Service, in that it is likely to require the firm to pay interest on the investment loss, from the date the consumer ceased to own the investment (akin to the fixed date for loss calculation in our timeline) up to the date the firm actually pays the redress.[8] It is also similar to the approach to pre- and post-judgment interest taken by the courts.

4.7. In the alternative to the above approach, FAIR Canada recommends that, where an interest payment on compensable losses is applicable, interest should be awarded if a complaint is not resolved (i.e. payment has been transferred to the complainant) within a prescribed amount of time from the date the complaint is made to the participating firm (for example, 90 days) rather than where an Investigation Report is issued. This would be a policy more closely aligned to the purpose of awarding interest, which is to compensate for the loss of the use of money, than the approach outlined in the Consultation. This approach would also incentivize firms to cooperate in reaching timely resolutions.

4.8. Under this alternative, FAIR Canada suggests that, where interest is warranted, the interest be calculated in the same manner as our preferred approach recommended above (i.e. based upon the fixed date for loss calculation up until the date the consumer receives the compensation).

5. Limitation period.

5.1. FAIR Canada agrees that a limitation period of six years from the time when the consumer knew or ought to have known there was a problem with their investments is fair, provided that a subjective standard is used; that is, the standard of a reasonable person with the consumer’s characteristics, including knowledge, experience and vulnerability. FAIR Canada believes that a subjective standard should be used, based on the particular client, with an appreciation of all the facts, including the consumer’s age, degree of reliance on the advisor, knowledge, understanding of account statements provided, and ability to identify a problem with the unsuitability of the investment.

5.2. It is unfair to vulnerable consumers, including persons with limited language skills, low financial literacy, and seniors who may have reduced mental abilities, to apply a limitation period without a full appreciation of these characteristics. Fifty-three percent (53%) of OBSI clients are sixty (60) years of age or older[9]; as noted in OBSI’s 2011 Annual Report, three of the top five seniors issues observed by OBSI include delegation of control of financial affairs, missing financial records, and unsuitable investments. These types of issues should weigh heavily in determining whether a consumer knew or ought to have known there was a problem with their investments, and if so, when they knew or ought to have known.

5.3. Given that OBSI’s process is not a court proceeding, and it is not subject to statutory limitation periods, OBSI should reserve the right to waive the self-imposed limitation period in exceptional cases where it is fair and reasonable to do so.

6. Provide loss calculation spreadsheets during investigation.

6.1. FAIR Canada questions why OBSI would propose to share versions of its loss calculation spreadsheets with firms without also sharing these with complainants. If firms are provided with working versions of such spreadsheets, FAIR Canada submits that these documents should also be provided to complainants, to allow them to participate fully in the dispute resolution process.

7. Investor responsibility (mitigation).

7.1. FAIR Canada has reservations about OBSI’s statement regarding “Investor Responsibility” as set out in the Consultation:

Once an investor is aware that his or her investments are unsuitable for them, they have the obligation to take steps to minimize their losses. If the investor continues to hold the investment, we may determine that they are responsible for any losses incurred from that point forward. What steps we would expect an investor to take and when we would expect the investor to take them will depend on their investment knowledge and the degree to which they relied on their advisor… [W]e evaluate investor responsibilities given the particular facts and circumstances in each case, considering the investor’s level of investment knowledge and degree of reliance on the advisor along with other factors.[10]

7.2. As noted in the U.K. Financial Services Consumer Panel’s (“FSCP”) position paper on Consumer Responsibility, “*a+ll [financial services] products involve an element of risk which few consumers are well-equipped to judge. They are often credence goods – meaning that consumers won’t know if they have performed as expected until a number of years have passed.”[11]

7.3. FAIR Canada views the assessment of investor responsibility to be a two-part process: (1) a determination of whether or not the investor, at some point, knew or ought to have known that his or her investments were unsuitable for them, and (2) a determination of what steps, if any, the investor was in a position to take to limit further losses.

“Knew or ought to have known”

7.4. FAIR Canada does not believe that consumers should be expected to “second guess” the suitability of recommendations. We caution that any determination that a consumer knew or ought to have known that a particular investment, portfolio or strategy was unsuitable for them must be based on clear evidence that the particular individual knew or ought to have known, taking into consideration factors such as financial literacy, reduced mental capacity, and language barriers. Consideration should also be given to the consumer’s awareness and understanding of the complex concept of suitability.

7.5. Furthermore, if, subsequent to the purchase, an investment firm or advisor realized or ought to have realized that the investment was unsuitable for the investor and did not (1) bring this to the attention of the consumer, and (2) provide a suggestion as to how to mitigate, full responsibility should fall to the firm and/or advisor. Responsibility to mitigate should not fall solely to the lesssophisticated, reliant party in the advisory relationship given the asymmetry of experience, investment knowledge, and power between the parties. As noted in the FSCP’s position paper, “…firms will always have more information, capability and resource at their disposal than the consumers they interact with.”[12] As such, firms should also have an obligation to mitigate in order to stem losses arising as a result of the advice they provide.

Appropriate steps to mitigate

7.6. While, in principle, we do not disagree that where consumers realize that their investments are unsuitable they may have some responsibility to stem their losses, we caution that consumers should not be penalized for not understanding the complex concept of “suitability”, for not knowing that they may have a responsibility to mitigate or for not knowing how to mitigate their losses, particularly where such losses arise as a result of professional investment advice.

7.7. We emphasize that any determination that a consumer is responsible for any losses incurred from a particular point forward must be based on clear and compelling evidence. Any reasonable effort on the part of the consumer to take steps to mitigate their losses should be subjectively considered, with respect to that particular consumer, and should reduce or absolve the consumer’s responsibility for any losses incurred from that time forward. A determination of the appropriate steps to mitigate should also consider any costs to liquidate any unsuitable investments.

8. Suitability and leverage.

8.1. FAIR Canada recommends that OBSI explicitly include the use of leverage in its suitability assessment process. In light of the growing problem with leverage in the sale of investment products and several Canadian securities regulators’ investor alerts[13] regarding the risks associated with the use of leverage and other anecdotal evidence of the harm posed to Canadian consumers, we consider it to be an important consideration in OBSI’s suitability assessment process.

We thank you for the opportunity to provide our comments and views in this submission. We welcome its public posting and would be pleased to discuss this letter with you at your convenience. Feel free to contact Ermanno Pascutto at 416-214-3443 (ermanno.pascutto@faircanada.ca) or Ilana Singer at 416-214-3491 (ilana.singer@faircanada.ca).

Sincerely,

(signature)

Canadian Foundation for Advancement of Investor Rights

[1] The Globe and Mail, “Ottawa sets new rules to settle consumer complaints against banks” (July 6, 2012), online: <http://www.theglobeandmail.com/globe-investor/ottawa-sets-new-rules-to-settle-consumer-complaints-againstbanks/article4394629/> and OBSI’s April 30, 2012 press release from the Board of Directors, online: <http://obsi.ca/UI/AboutUs/PressReleases.aspx?csid1=37>.

[2] The Navigator Company, “Ombudsman for Banking Services and Investments Report 2011 Independent Review” (2011), online: <http://www.obsi.ca/images/document/Independent_Review_of_OBSI_2011_2.pdf> at page 17 (the “Khoury Report”).

[3] Ibid. at page 16.

[4] Supra note 1.

[5] Khoury Report, supra note 2.

[6] Khoury Report, ibid. at page 16.

[7] Ombudsman for Banking Services and Investments, Terms of Reference, online: <http://www.obsi.ca/images/document/Dec2010_English.pdf>.

[8] Financial Ombudsman Service, “A quick guide to calculating redress in investment complaints” (February 2012), online: <http://www.financial-ombudsman.org.uk/publications/technical_notes/QG5.pdf> at page 2.

[9] Ombudsman for Banking Services and Investments, 2011 Annual Report, online: <http://www.obsi.ca/images/document/up-3OBSI_Annual_Report_2011.pdf>.

[10] Ombudsman for Banking Services and Investments, “Summary of Public Comments Relating to OBSI’s Suitability and Loss Assessment Process, and Request for Comments on Proposed Changes” (May 10, 2012), online:

<http://www.obsi.ca/images/document/up-Consultation_Paper___May_2012___FINAL_.pdf>.

[11] Financial Services Consumer Panel, “Consumer Responsibility – Consumer Panel Position Paper” (February 2012), online: <http://www.fs-cp.org.uk/publications/pdf/position-paper-consumer-responsibility.pdf> at page 3.

[12] Ibid. at page 5.

[13] Ontario Securities Commission, “OSC Investor News – Important information about the risks of leveraged investing and costs of investing” (January 23, 2012), online: <http://www.osc.gov.on.ca/en/Investors_inv_news_20120123_costinvesting.htm> and New Brunswick Securities Commission, “INVESTOR ALERT: The Risks of Borrowing Money to Invest” (17 February 2012), online: <http://www.nbsc-cvmnb.ca/nbsc/news_content_display.jsp?news_id=325&id=24&pid=4>.